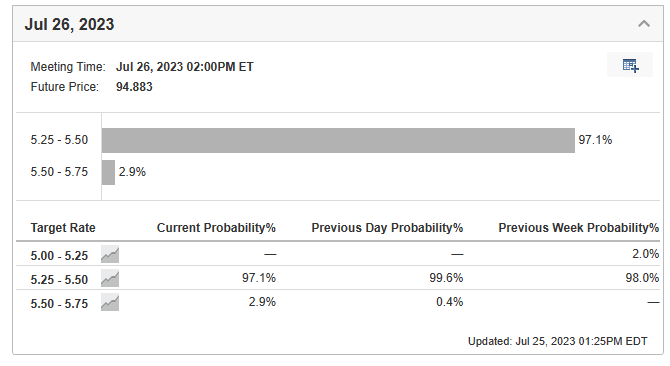

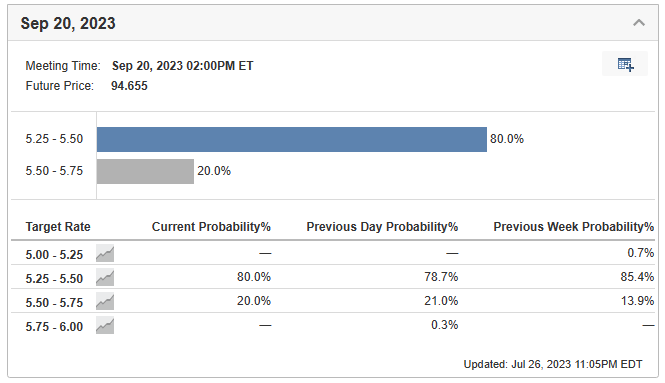

Going into FOMC, the market had expected with near certainty that the Federal Reserve would raise interest rates by 25 bps, and Powell did not disappoint. The Feds raised rates by 25 bps to 5.25-5.50% but remained tight-lipped on whether we would see another increase in September. However, we can see with this Federal Reserve Rate Monitoring Tool that the market is putting the probability of another 25bps hike in September at 20 percent at the moment.

Going into FOMC

After FOMC

And despite the continuing rate hikes, the market finished relatively flat for the day. However, those of us with subscriptions to the dark pool exchanges can see that institutions were very active behind the scenes.

DIA finished the day +0.26%. More importantly, the index is right on a major resistance trendline that goes back to January 2022.

SPY finished the day +0.02% and remains in this resistance zone that also extends back to January 2022.

QQQ was the only index that finished red by -0.33%. The technology index is currently in a rising wedge and sitting on 2 near-term supports. One in gray that extends from May 5 and one in green from July 13.

Tech bulls want both of these supports to hold, otherwise they would risk seeing a sell off to $370 where the red trendline is or worse $360 where the dotted gray lines are.

Dark Pools

Recall in my previous post Dark Pool Activity Picks Up Ahead of FOMC, I noted 2 orders that investors should pay attention to. These are the orders from July 18 for $3.5 billion at the $454.10 level and $ 2.6 billion at the $454.19. Then for the last 3 days, we saw >$13.925b hit the tape between a $1 range at…